Market News

Article: Consumer Price Index and Unemployment Datasets for November of 2024

Right Click and Maginify or Open Picture in a New Tab.

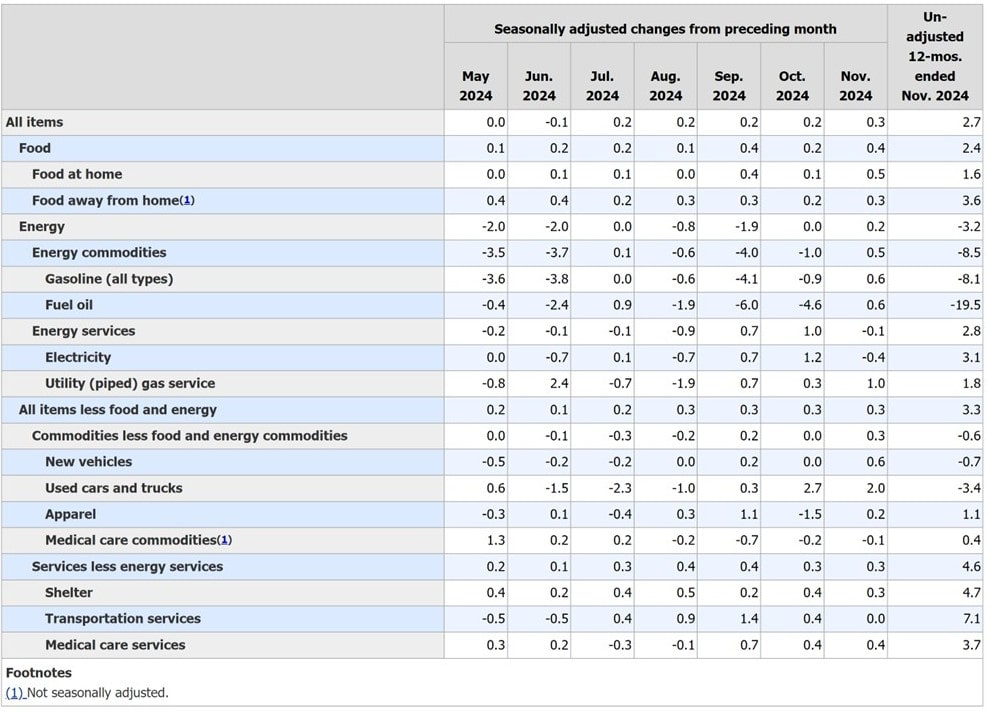

Washington DC: On December 11, 2024, the Bureau of Labor Statistics released economic news about the economy for November 2024. It appears the Consumer Price Index for All Urban Consumers (CPI-U) had increased 0.3 percent, according to BLS.gov. It appears food, gasoline, oil used to heat homes, new and used vehicles, natural gas, and medical care service lead the way in the increase in inflation and after only rising 0.2 percent in each of the previous 4 months. The fed obviously doesn't have control over inflation yet and lowering the interest rate doesn't seem to be help either. BLS states, all items index over the last 12 months have increased 2.7 percent before the seasonal adjustment.

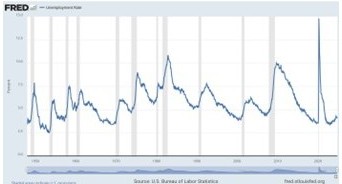

The unemployment rate also appeared to climb again in November 2024 to 4.2% from 4.1% in October of 2024 according to Federal Reserve Bank of St. Louis. Labor force data is restricted to people 16 years of age and older, which currently reside in 1 of the 50 states or the District of Columbia, who do not reside in institutions (e.g., penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces either. This rate is defined as the U-3 measure of labor underutilization and it indicates that people are receiving state unemployment checks.

Right Click and Maginify or Open Picture in a New Tab.

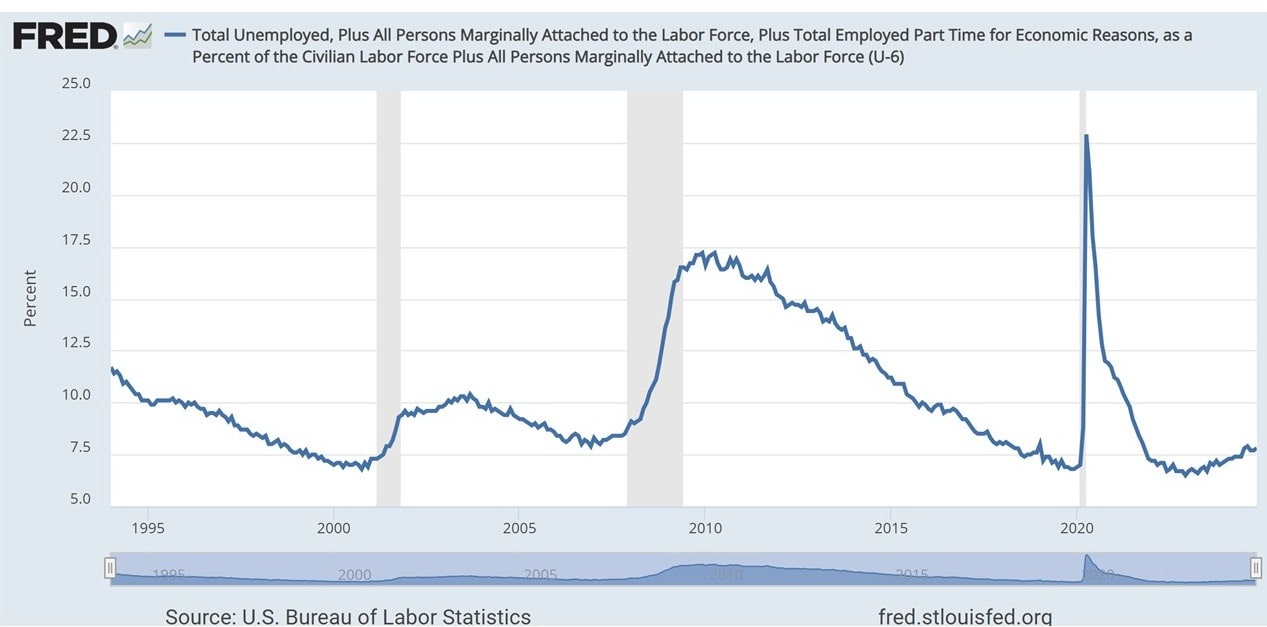

The U-6 rate also increased from 7.7 in October 2024 to 7.8 in November 2024 and this indicates a rate that measures the percentage of the U.S. labor force that is unemployed, plus those who are underemployed, marginally attached to the workforce, and have given up looking for work and no longer are receiving state unemployment. We don't know much about if people have actually giving up up looking for work, but the people are definitely not receiving any help from their state's unemployment office. These are people who are no longer able to get help as their state benefits have been exhausted. If you want to really know how well the economy is doing, you definitely want to look at this number as its the best indicator. As you can see, the economy is definitely getting worse and help (President Elect Trump) can't get here soon enough.

Right Click and Maginify or Open Picture in a New Tab.

All three market index's were down today including after hours trading.

- Dow Index: 43,914.12 -234.44 0.53%

- S&P 500 Index: 6,051.25 -32.94 0.54%

- NASDAQ Index: 19,902.84 -132.05 0.66%

- Attribution: Peer Reviewed Politics™ | Media Attribution: Article - Peer Reviewed Politics™, Data Attribution - BLS.gov and Federal Reserve Bank of St. Louis | Author(s): @TeaPartier_Al - Twitter | Date: November 12, 2024 | Duration: 00:00:00 | Photo/Video Credit: Graphs: Snapshot of the BLS.gov and Federal Reserve Bank of St. Louis Datasets

Article: Recession on the Horizon?

Is it Baked Into the Cake?

Peer Reviewed Politics™: Not sure if anyone is paying attention, but after the Pandemic, the unemployment rate has been falling since April 01, 2020, whereas the Trump administration had put into effect policies that controlled and brought down the unemployment rate after the pandemic. It drove down unemployment rate from its highs of 14.8% during the height of the pandemic to 6.2% in February 01, 2021, after Former President Trump had left office.

This was the fastest unemployment recovery of any president in the history of the United States. A lot of policies (removal of regulations) the were left unchanged for a while by the Biden Administration during the first half of Biden’s Administration’s term. Even with the high inflation, which was caused by the Biden Administration from the frivolous spending, the unemployment rate still continued to drop, but not as fast as it did under former president. Biden Administration and congress policies ended up adding more to the debt with the uncontrolled spending. Congress and the president started to spend more and more money in 2021 and has continued into 2024 on everything from Covid, the war in Ukraine, and more whereas this spending had slowed down the pandemic recovery and the drop in unemployment.

In the first 6 month of the Biden Administration, the unemployment rate dropped only 1.1% as compared to the Trump Administration unemployment rate drop of 8.0% from April 01, 2020 to October 01, 2020. Even after a lot of spending after the pandemic to get the economy back on track, the unemployment rate from October 01, 2020 to February 01, 2021 continued to drop from 6.8% to 6.2% when democrat spending was starting to get out control in the House and Senate.

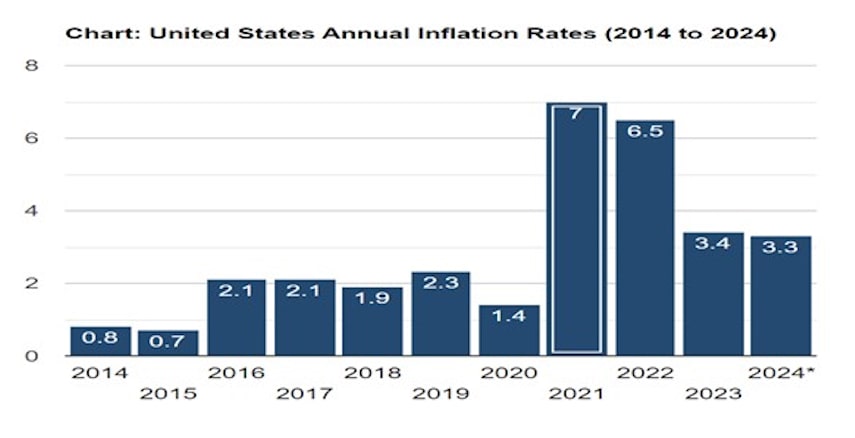

Since Biden took over the Presidency on January 20, 2021, the unemployment rate has continued to drop, but spending became a lot worst, which basically caused the worst inflation our country has seen in more than 40 years, since the Carter Administration. Inflation has recently has slowed down some, but inflation continues to adds up to be a 20.4% increase, since the beginning of 2021 when President Biden took office. When compared to Former President Trump total inflation of 7.7%, which was during a pandemic. Biden administration inflation was more than 12.7% than Trump’s inflation for 4 years. Biden term is still not finished, either.

Even with all the spending and inflation, the unemployment rate had continued to very slowly to drop from January 20, 2021 (6.2%) until April 01, 2023 (3.4%), but now all the spending and inflation has finally caught up with the good economic planning by the Trump Administration policies and the low unemployment rate. This is because consumers now have much less money in their bank accounts due to inflation, according to bea.gov.

The most recent personal saving rate data for May of 2024, the overall U.S. consumers personal saving rate was at 3.9% versus 19.3% when former President Trump left office. Personal savings since the year 2000 had been hovering around 5.0%, whereas before 1999, the savings was closer to 10%. Now that inflation has taken its toll on consumers and businesses, we are now starting to see increases in the unemployment rate and business laying off people and closing up stores. On April 01, 2024, the unemployment rate was 3.4%, now the unemployment rate is at 4.1% in June 01, 2024. This is due to people spending much less money and businesses making less profits.

In recent news, Walgreens is closing a huge number of stores and laying off people. The retail giant hasn't divulged any exact figures, but it advised on Thursday, June 27, 2024 that it plans to shut down "significant" amount of stores, which are under-performing across the nation. It's part of an ongoing optimization strategy Walgreens is planning on taking. Walmart has already closed six stores, so far this year. These closed locations were in California, Maryland, Ohio, and San Diego. Best Buy plans to close 10 to 15 stores by 2025 and this decision adds to the closure of 24 stores in 2023 and 2024. Dollar Tree, which owns Family Dollar, is closing stores in the first half of 2024 too, with an additional 370 set to close upon their lease expiration. According to the Family Dollar, mismanagement, poor store conditions, and competition from other discount retailers, besides inflation has impacted Family Dollar’s customer base and profits. Rite Aid is closing many locations due to financial difficulties exacerbated by the COVID-19 pandemic and fierce competition. The Gap and Banana Republic stores are reducing their real estate footprint and are enhancing its online presence. The Gap and Banana Republic are also struggling with declining sales. Macy’s is planning on shut down approximately 150 under-performing U.S. stores through 2026, including 50 locations in 2024. Neiman Marcus is closing some of its Last Call outlet stores following bankruptcy restructuring. Victoria’s Secret has closed a bunch of stores and plans to close a total of 50 stores in 2024. Victoria’s Secret is struggling with a lack of sales in this tough consumer spending atmosphere. Party City has closed over 30 stores across the United States in 2024 due to lack luster sales. The Body Shop, a British cosmetic chain shut down its operation in the U.S. and has closed its website too, due to very significant decline in sales.

According to seekingalpha.com, in recent weeks, the spread between 10-year and 3-month constant maturity U.S. Treasuries has been rising, which points to the likelihood the downward trend in the recession probability's trajectory may soon reverse. Recession Probability Track shows the recession probability hovering between 67% and 77%, while the Federal Funds Rate has been held at an average of 5.33%.

Peter Berezin, a chief global strategist at BCA Research said, "The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. Growth in the rest of the world will also slow sharply." Peter Berezin stated that Rising unemployment could ultimately lead to consumers reducing their spending to build up their "precautionary savings," and that will happen as consumers ability to borrow money narrows due to rising delinquency rates.

Peer Reviewed Politics analysis of consumer spending and inflation seems to be spot on with BCA Research and other analysis. What we don't agree on with what analysis are claiming, "if interest rates don’t come down, this will result in the downturn in the economy." We believe if the Fed reduces the interest rates to try and stop the down turn in the economy, you will see inflation once again rise during the down turn.

We believe the problem is baked into the cake, because of what the Biden Administration did when they came into

office and then implemented their bad economic policy, cutting energy production, and spending like there is no

tomorrow. Sorry to say, its going to take more than cutting the interest rate to fix this mess that the

Biden Administration caused.

- Attribution: Peer Reviewed Politics™ | Media Attribution: Article - Peer Reviewed Politics™, Data Attribution - seekingalpha.com and Peter Berezin, a chief global strategist at BCA Research, BEA.gov | Author(s): @TeaPartier_Al - Twitter | Date: July 07, 2024 | Duration: 00:00:00 | Photo/Video Credit: Graphs: Recession Probability-Political Calculations, BEA.gov

Don't You Know that Inflation is UP, UP, UP for April 2024?

Washington, DC: Consumer Price Index – April 2024 News Release

“Don't you know the inflation rate is going up, up, up, up, up?”

Shadoobie, Shattered...

"To live in this country you must be tough, tough, tough, tough, tough, tough, tough."

Shadoobie, Shattered,

Shadoobie, Shattered, Shattered.

"We've got Democrats on the west side, Republican uptown."

Shadoobie, Shattered...

"What a mess, this country is in tatters, I've been shattered."

Shadoobie, Shattered.

"My brain's been battered, they splattered Trump all over Manhattan."

Shadoobie, Shattered...

Well, that's how we feel after seeing this Consumer Price Index report for April 2024. Why are we saying this? The inflation rate is up again for April 2024.

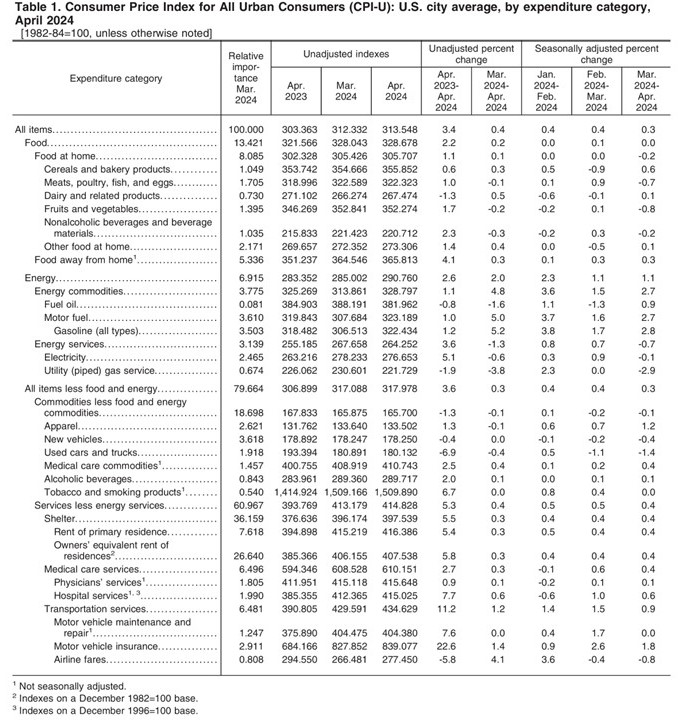

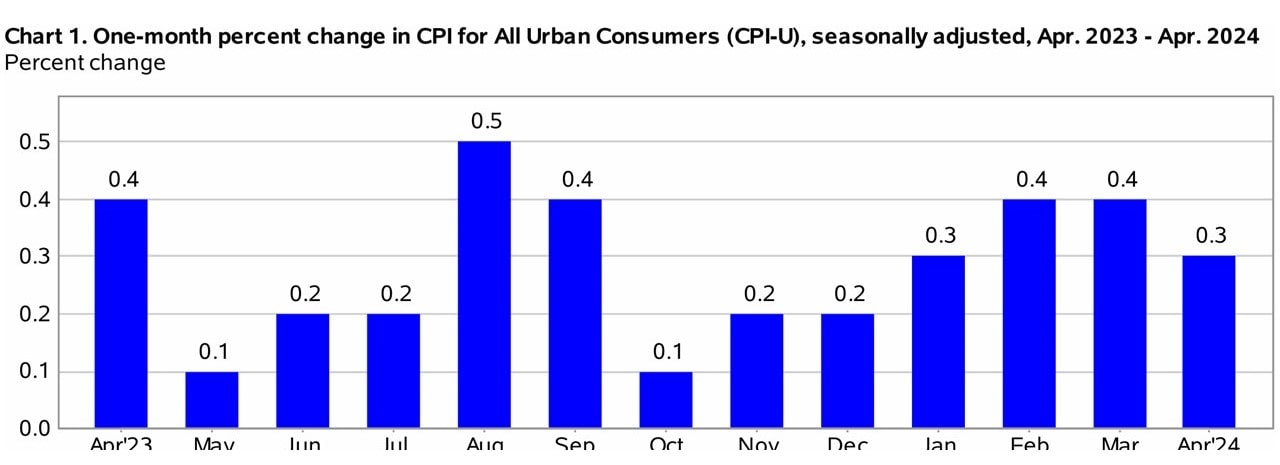

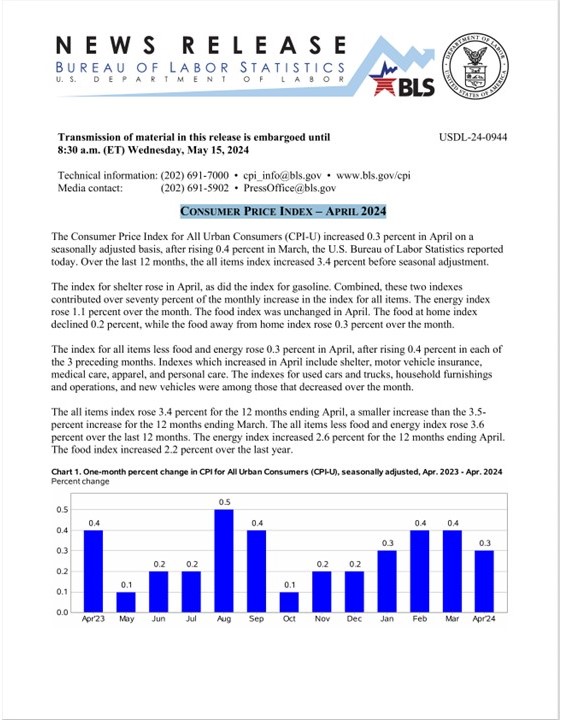

According to the Bureau of Labor Statics, the Consumer Price Index for All Urban Consumers (CPI-U) has increased again, this time another 0.3 percent in April of 2024, after rising 0.4 percent in March of 2024.

In the last 12 months, all the items index have increased 3.4 percent before the seasonal adjustment. The CPI index for shelter and gasoline rose in April 2024, no surprise here if you have a roof over your head and drive to work and/or the store to buy necessities. These two indexes combined, contributed to over seventy percent of the monthly increase in the index for all items according the blss.gov.

The energy cost index rose another 1.1 percent over the month. The only index which was virtually unchanged in April of 2024, was the food index. To break this down more so you real can understand the food index, your food at home index declined 0.2 percent but its still up, while your food away from home has rose another 0.3 percent over the month, which in effect leaves the index unchanged pretty much. If you want to be technical, its up 0.1 percent if you eat out.

The index for all items, less food and energy, rose again, this time 0.3 percent for April 2024, after rising 0.4 percent in each of the 3 preceding months. If you think inflation is less in this report, yes only less than the previous months, there is still inflation that's being added to the previous month's inflation and the previous years of high inflation under the Biden Administration, so no, there has not been any de-inflation. Wages are just not keeping up with the rise in inflation, either.

The indexes that have increased in April 2024 are "Shelter, Motor Vehicle Insurance, Home Insurance, Medical Care, Apparel, and Personal Care items." While inflation for used cars, trucks, new household furnishings and operations, and new vehicles were among those items that seen decreases in inflation over the month, but again there is no de-inflation as inflation is still going up, up, and up.

The items in consumer price index rose 3.4 percent for the 12 months ending April, which is a smaller increase than the 3.5 percent increase for the 12 months ending March, but remember, this is not de-inflation, it's still an increase in inflation, just not as much.

All items, less the food and energy index, again rose 3.6 percent over the last 12 months. Yes, the fed said it increased again. The energy index also increased 2.6 percent for the 12 months ending in April or 2024. The food index too increased 2.2 percent over the last year.

We've included a chart here to view, noting nothing is going negative in the inflation rate. The interest rate

continues to climb, month after month, unlike your wages...

Yes, Shadoobie, Shattered,

Shadoobie, Shattered, Shattered...

Courtesy of bls.gov

Click on the picture below to see the full report.

- Attribution: Peer Reviewed Politics™ | Story Attribution: Peer Reviewed Politics Article - @Teapartier_Al on X.com / Consumer Price Index Report for April 2024 - Bureau of Labor Statics on bls.gov | Peer Reviewed Politics Article Author: @TeaPartier_Al on X.com | Date: June 03, 2024 | Video Clip Duration: 00:00:00 | Photos and Video Credit: Snapshot of Graph - BLS.gov